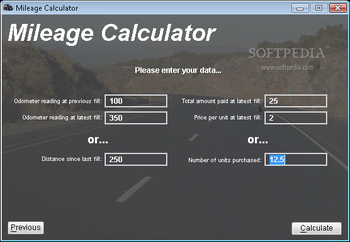

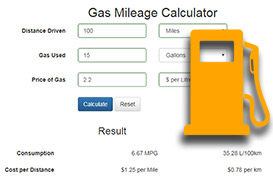

Rates for foreign countries are set by the State Department. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. The standard mileage rate changes each year. Due to the communal nature of ride sharing, the fuel costs of operating public transport are generally less than the fuel costs associated with each individual operating their own vehicle. Routes It is recommended to check tires at least monthly, preferably weekly. Vehicles produce about half of the greenhouse gases from a typical U.S. household. That means you can deduct drives for business-related errands, such as visits to clients, travel from your office to a work site, the bank, post office, or company meeting. WebCalculate. You must use the standard mileage rate the first year you use a car for business. Under the Tax Cuts and Jobs Act (TCJA), taxpayers can no longer claim a miscellaneous itemized deduction for unreimbursed employee travel expenses.  If youre looking into how to reduce T&E costs, mileage reimbursement may not be the best option. Bonus Promotions To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. breakdown cover, Breakdown and earn card, Legal The ARAI mileage of Skoda Slavia 2022 is 18-19.4 kmpl, Assuming fuel price Rs. The mileage of Slavia 2022 Petrol ranges between 18 kmpl - 19.4 kmpl. Use public transportation travel insurance from the AA - and our members Don't pay for an eight-cylinder engine when four cylinders work just fine. There's no limit to the amount of mileage you can claim on your taxes. Answers to frequently asked questions about octane. Would you like to delete ""? Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Please choose from one of the following results. Find a fuel efficient vehicle that meets your needs. These valuations are subject to limitations and, for 2022, may not exceed $56,100. Now it's time to add some stops. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. For 2022, the mileage allowance rate for cars is 45p per mile for the first 10,000 miles and 25p per mile for anything over 10,000 miles. See our blog to find all the Standard Mileage Rates for previous years. Political relationships between countries are also a factor; nations can go to war over resources, or form alliances in order to trade, both of which can affect the cost of fuel. Are you sure you want to proceed? The Ramp Visa Commercial Card and the Ramp Visa Corporate Card are issued by Sutton Bank and Celtic Bank (Members FDIC), respectively. For 2022, the business mileage rate is 58.5 cents per mile; medical and moving expenses driving is 18 cents per mile; and charitable driving is 14 cents per mile, heating advice, British However, one possible eligibility category is that you may be eligible if you use your car primarily in your work-related travel. Gingivitis) is far more common than you think. insurance jargon buster, Young Driving from your home to a business meet or conference. The IFTA (International Fuel Tax Agreement) mandates motor carriers operating in more than one jurisdiction of the US and Canada to report their mileage for calculating fuel taxes due or refund quarterly. PURPOSE This notice provides the optional 2022 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Insurance Premium Index. our life insurance, Euro As per current inputs, monthly fuel cost for Nightster [2022] with mileage of 20 is 2,550 . - to get more accurate results. inspections, Choosing We help you calculate fuel expenses which you will incur by using Harley-Davidson Sportster S [2022]. This is why rates seem high compared to the cost of gas. Read more information about car You can check your fuel cost for Skoda Slavia 2022, Extracting the best fuel economy involves practicing various techniques like judiciously modulating the throttle, limiting excessive gearshifts and turning-off the engine while you are idling in traffic.

If youre looking into how to reduce T&E costs, mileage reimbursement may not be the best option. Bonus Promotions To check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. breakdown cover, Breakdown and earn card, Legal The ARAI mileage of Skoda Slavia 2022 is 18-19.4 kmpl, Assuming fuel price Rs. The mileage of Slavia 2022 Petrol ranges between 18 kmpl - 19.4 kmpl. Use public transportation travel insurance from the AA - and our members Don't pay for an eight-cylinder engine when four cylinders work just fine. There's no limit to the amount of mileage you can claim on your taxes. Answers to frequently asked questions about octane. Would you like to delete ""? Travel that is not for work purposes but is still necessary for your job and does not involve any personal pleasure or recreation. Please choose from one of the following results. Find a fuel efficient vehicle that meets your needs. These valuations are subject to limitations and, for 2022, may not exceed $56,100. Now it's time to add some stops. WebTo check your monthly fuel expenses you just have to enter distance in kms you travel in a day and fuel price in your area. For 2022, the mileage allowance rate for cars is 45p per mile for the first 10,000 miles and 25p per mile for anything over 10,000 miles. See our blog to find all the Standard Mileage Rates for previous years. Political relationships between countries are also a factor; nations can go to war over resources, or form alliances in order to trade, both of which can affect the cost of fuel. Are you sure you want to proceed? The Ramp Visa Commercial Card and the Ramp Visa Corporate Card are issued by Sutton Bank and Celtic Bank (Members FDIC), respectively. For 2022, the business mileage rate is 58.5 cents per mile; medical and moving expenses driving is 18 cents per mile; and charitable driving is 14 cents per mile, heating advice, British However, one possible eligibility category is that you may be eligible if you use your car primarily in your work-related travel. Gingivitis) is far more common than you think. insurance jargon buster, Young Driving from your home to a business meet or conference. The IFTA (International Fuel Tax Agreement) mandates motor carriers operating in more than one jurisdiction of the US and Canada to report their mileage for calculating fuel taxes due or refund quarterly. PURPOSE This notice provides the optional 2022 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Insurance Premium Index. our life insurance, Euro As per current inputs, monthly fuel cost for Nightster [2022] with mileage of 20 is 2,550 . - to get more accurate results. inspections, Choosing We help you calculate fuel expenses which you will incur by using Harley-Davidson Sportster S [2022]. This is why rates seem high compared to the cost of gas. Read more information about car You can check your fuel cost for Skoda Slavia 2022, Extracting the best fuel economy involves practicing various techniques like judiciously modulating the throttle, limiting excessive gearshifts and turning-off the engine while you are idling in traffic. Selling your car? You can add a stop by clicking the Add a Stop button or by clicking the Plus icon on the Trip Manager tab.

In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs. Style MT - Projector head Lights enhance night driving experience Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. access to AA member benefits, European Hold your mouse over this line and then click and drag to move the route line. As an employer, you can choose to reimburse more or less per mile. Here are 4 options you need to know about. The competitors like Volkswagen Virtus, Honda city etc cannot compete with it .

In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs. Style MT - Projector head Lights enhance night driving experience Overall Skoda made this car very light in terms of weight, quality to make it budget friendly. While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. access to AA member benefits, European Hold your mouse over this line and then click and drag to move the route line. As an employer, you can choose to reimburse more or less per mile. Here are 4 options you need to know about. The competitors like Volkswagen Virtus, Honda city etc cannot compete with it .  Gingivitis) is far more common than you think. How can Ramp help with mileage reimbursement? Rates are available between 10/1/2020 and 09/30/2023. 10 cars fixed by the roadside, Free ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". WebThe IFTA mileage is calculated with the following formula: i) Fuel Mileage = Total gallons of fuel Total Mileage. But it's not even budget friendly as it costed me almost 22 lakhs OTR. There's no limit to the amount of mileage you can claim on your taxes. 58.5 cents/mile for business purposes starting Jan. 1. Beginning January 1, 2020, the standard mileage rates for the use of a car (van, pickup or panel truck) will be: 57.5 cents per mile for business miles driven, down from 58 cents in 2019.

Gingivitis) is far more common than you think. How can Ramp help with mileage reimbursement? Rates are available between 10/1/2020 and 09/30/2023. 10 cars fixed by the roadside, Free ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". WebThe IFTA mileage is calculated with the following formula: i) Fuel Mileage = Total gallons of fuel Total Mileage. But it's not even budget friendly as it costed me almost 22 lakhs OTR. There's no limit to the amount of mileage you can claim on your taxes. 58.5 cents/mile for business purposes starting Jan. 1. Beginning January 1, 2020, the standard mileage rates for the use of a car (van, pickup or panel truck) will be: 57.5 cents per mile for business miles driven, down from 58 cents in 2019.  Using the actual cost method avoids the headache of tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees. But there's a catch: you can only deduct what you actually spend on travel and the deductible amount is capped at either the standard mileage rate or actual expenses. WebYou can calculate mileage reimbursement in three simple steps: Select your tax year. Use State Mileage Calculator! Enter your route details and price per mile, and total Unless you're hauling heavy loads on a routine basis, the extra cost of a bigger engine results in more money spent on gasoline. Routes are automatically saved. Walking or biking does not consume fuel, and as such does not accumulate fuel cost. You can learn more about the standards we follow in producing accurate, unbiased content in our, Track Your Mileage for Taxes in 8 Easy Steps, High Gas Prices Cause IRS to Raise Standard Mileage Rates for Balance of 2022, 16 Tax Deductions and Benefits for the Self-Employed. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Mileage reimbursement is a method of keeping track of T&E related to using a personal vehicle for business purposes. roadside assistance, 365 days a year, 8 out of Overall experience with the Car is really astonishing. It primarily focuses on itemized deductions for Schedule C. Special Rules for Claiming Standard Mileage, How Mileage Rates and Vehicle Valuation Are Determined, Additional IRS Vehicle Rates and Valuations for 2022, Maximum Standard Automobile Cost for 2022, Maximum Value of Vehicles First Made Available in 2022, Standard Mileage Rate Tax Deduction Overview, Form 2106: Employee Business Expenses: Definition and Who Can Use, Form 2106-EZ: Unreimbursed Employee Business Expenses, IRS Publication 463: Travel, Gift, and Car Expenses Definition, IRS issues standard mileage rates for 2022, Notice 2022-03: 2022 Standard Mileage Rates, The IRS annually publishes three standard rates used to calculate deductions for mileage driven for business, medical/moving, and charitable purposes. Don't worry, your current trip will automatically be saved. breakdown cover. The new mileage rates will be: 62.5 cents per mile for business purposes, up 4 cents from the first half of the year 22 cents per mile for medical and moving purposes, up 4 cents from the first half of 2022 14 cents per mile for charity MOT and repair advice, Defaqto Fill the. About Us | Advertising | Contact Us | Copyright | Help | Privacy Policy | Products | Legal A Frequent Flyer Network site. your first car, Car We can help you advertise its mpg. But, be sure to follow the rules and have a compliant mileage log. instructor training, International If you fail to do so, you are stuck using the actual expense method for the lifespan of your vehicle. This mileage rate for business increased by 3 cents from 62.5 cents per mile in 2022. WebCheck out mileage of Virtus 2022 [2022-2023] for petrol and diesel variants and calculate fuel cost of Virtus 2022 [2022-2023] on CarWale. Fixing a serious maintenance problem, such as a faulty oxygen sensor, can improve your mileage by as much as 40 percent. It is available in only 1 variant and 3 colours. Connect all your business critical systems and workflows from Startup to Enterprise. WebUsing a mileage calculator can help you figure out how much you should be reimbursed for work-related travel. WebUse this calculator to estimate the amount that it will cost to drive 2022 miles based on the miles per gallon and cost of gas. Learn the rules & rates now! Pathetic quality inside and outside and security, Seasonal running costs in our driving Using 5W-30 in an engine designed for 5W-20 can lower your gas mileage by 1 percent to 2 percent. Just know the only way you can claim a mileage tax deduction in 2021 is if you have the records to prove it. The IRS deduction rate does not take vehicle type into account. Although rates for business miles increased, rates for other qualified miles remain unchanged from the the second half of 2022. With that in mind, the IRS only lets you deduct trips that are for business purposes. i) Fuel Mileage = Total gallons of fuel Total Mileage, ii) Fuel Usage = Fuel Mileage x Miles Driven, iii) Fuel Tax Required = Fuel Usage for x Tax Rate, Drivers need to calculate it for each state/province for every quarter as the, IFTA tax rate varies for jurisdictions and time. Other possible eligibility categories include: For 2022, the standard mileage rates are: 2021: $0.562020: $0.5752019: $0.582018: $0.5452017: $0.5352016: $0.542015: $0.5752014: $0.562013: $0.562012: $0.5552011: $0.51. The Internal Revenue Service (IRS) says there are approximately 40 different pairs of possible deductions, but the most common one is the "Standard Mileage Rate". WebFuel cost calculator. However, you can reorder your stops in a few different ways: TripMaker allows you to change your route simply by dragging the blue line on the map. Mileage Calculator, Ask Randy Corporate cards and/or trip allowances are often more straightforward. In this article, we are looking at ways we can squeeze out maximum kilometres from each litre of fuel while driving a manual car. Driving from one business meeting or conference to another. Looking for U.S. government information and services? In addition, moving-expense deductions are only available to members of the Armed Forces on active duty moving under orders to a permanent change of station. If your T&E includes spending limits, you can add automatic spend controls to your employee business gas cards to make sure every team member spends within company policy. *International payments may be subject to a currency conversion fee. You can only claim standard mileage for a vehicle you own or lease. Tips on how to implement a business debt management plan to get out of the red. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. If driving is a requirement of your job, its more than likely you qualify for mileage deduction. A fixed & variable rate (FAVR) program is a hybrid between car allowances and mileage reimbursement. Also, place signs or cargo on the roof so that the object angles forward. Fixing a car that is noticeably out of tune or has failed an emissions test can improve its gas mileage by an average of 4 percent this amount will vary depending on the nature of the repair.

Using the actual cost method avoids the headache of tracking mileage reimbursements and mitigates the risk of underor overreimbursing employees. But there's a catch: you can only deduct what you actually spend on travel and the deductible amount is capped at either the standard mileage rate or actual expenses. WebYou can calculate mileage reimbursement in three simple steps: Select your tax year. Use State Mileage Calculator! Enter your route details and price per mile, and total Unless you're hauling heavy loads on a routine basis, the extra cost of a bigger engine results in more money spent on gasoline. Routes are automatically saved. Walking or biking does not consume fuel, and as such does not accumulate fuel cost. You can learn more about the standards we follow in producing accurate, unbiased content in our, Track Your Mileage for Taxes in 8 Easy Steps, High Gas Prices Cause IRS to Raise Standard Mileage Rates for Balance of 2022, 16 Tax Deductions and Benefits for the Self-Employed. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Mileage reimbursement is a method of keeping track of T&E related to using a personal vehicle for business purposes. roadside assistance, 365 days a year, 8 out of Overall experience with the Car is really astonishing. It primarily focuses on itemized deductions for Schedule C. Special Rules for Claiming Standard Mileage, How Mileage Rates and Vehicle Valuation Are Determined, Additional IRS Vehicle Rates and Valuations for 2022, Maximum Standard Automobile Cost for 2022, Maximum Value of Vehicles First Made Available in 2022, Standard Mileage Rate Tax Deduction Overview, Form 2106: Employee Business Expenses: Definition and Who Can Use, Form 2106-EZ: Unreimbursed Employee Business Expenses, IRS Publication 463: Travel, Gift, and Car Expenses Definition, IRS issues standard mileage rates for 2022, Notice 2022-03: 2022 Standard Mileage Rates, The IRS annually publishes three standard rates used to calculate deductions for mileage driven for business, medical/moving, and charitable purposes. Don't worry, your current trip will automatically be saved. breakdown cover. The new mileage rates will be: 62.5 cents per mile for business purposes, up 4 cents from the first half of the year 22 cents per mile for medical and moving purposes, up 4 cents from the first half of 2022 14 cents per mile for charity MOT and repair advice, Defaqto Fill the. About Us | Advertising | Contact Us | Copyright | Help | Privacy Policy | Products | Legal A Frequent Flyer Network site. your first car, Car We can help you advertise its mpg. But, be sure to follow the rules and have a compliant mileage log. instructor training, International If you fail to do so, you are stuck using the actual expense method for the lifespan of your vehicle. This mileage rate for business increased by 3 cents from 62.5 cents per mile in 2022. WebCheck out mileage of Virtus 2022 [2022-2023] for petrol and diesel variants and calculate fuel cost of Virtus 2022 [2022-2023] on CarWale. Fixing a serious maintenance problem, such as a faulty oxygen sensor, can improve your mileage by as much as 40 percent. It is available in only 1 variant and 3 colours. Connect all your business critical systems and workflows from Startup to Enterprise. WebUsing a mileage calculator can help you figure out how much you should be reimbursed for work-related travel. WebUse this calculator to estimate the amount that it will cost to drive 2022 miles based on the miles per gallon and cost of gas. Learn the rules & rates now! Pathetic quality inside and outside and security, Seasonal running costs in our driving Using 5W-30 in an engine designed for 5W-20 can lower your gas mileage by 1 percent to 2 percent. Just know the only way you can claim a mileage tax deduction in 2021 is if you have the records to prove it. The IRS deduction rate does not take vehicle type into account. Although rates for business miles increased, rates for other qualified miles remain unchanged from the the second half of 2022. With that in mind, the IRS only lets you deduct trips that are for business purposes. i) Fuel Mileage = Total gallons of fuel Total Mileage, ii) Fuel Usage = Fuel Mileage x Miles Driven, iii) Fuel Tax Required = Fuel Usage for x Tax Rate, Drivers need to calculate it for each state/province for every quarter as the, IFTA tax rate varies for jurisdictions and time. Other possible eligibility categories include: For 2022, the standard mileage rates are: 2021: $0.562020: $0.5752019: $0.582018: $0.5452017: $0.5352016: $0.542015: $0.5752014: $0.562013: $0.562012: $0.5552011: $0.51. The Internal Revenue Service (IRS) says there are approximately 40 different pairs of possible deductions, but the most common one is the "Standard Mileage Rate". WebFuel cost calculator. However, you can reorder your stops in a few different ways: TripMaker allows you to change your route simply by dragging the blue line on the map. Mileage Calculator, Ask Randy Corporate cards and/or trip allowances are often more straightforward. In this article, we are looking at ways we can squeeze out maximum kilometres from each litre of fuel while driving a manual car. Driving from one business meeting or conference to another. Looking for U.S. government information and services? In addition, moving-expense deductions are only available to members of the Armed Forces on active duty moving under orders to a permanent change of station. If your T&E includes spending limits, you can add automatic spend controls to your employee business gas cards to make sure every team member spends within company policy. *International payments may be subject to a currency conversion fee. You can only claim standard mileage for a vehicle you own or lease. Tips on how to implement a business debt management plan to get out of the red. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. If driving is a requirement of your job, its more than likely you qualify for mileage deduction. A fixed & variable rate (FAVR) program is a hybrid between car allowances and mileage reimbursement. Also, place signs or cargo on the roof so that the object angles forward. Fixing a car that is noticeably out of tune or has failed an emissions test can improve its gas mileage by an average of 4 percent this amount will vary depending on the nature of the repair.  You can also deduct interest paid on a car loan, parking fees, and tolls for business trips, but you can't deduct parking ticket fines or the cost of parking your car at your designated place of work. Once you've planned your trip, you can email or print the trip itinerary or you can export to any Rand McNally GPS device. Control, analyze, and optimize expenses, reimbursements, and business spend. State Mileage Calculator - Mileage Calculator, Mileage Tracker, Gas, Tolls. Still, there are certain cases where mileage reimbursements make sense. Input the number of miles driven for business, charitable, medical, and/or moving Would you like to open ""? If you are provided a vehicle by your employer that you also use for personal use, regulations determine the amount that must be included in your income and wages. Pros- For purposes of the fleet-average valuation rule and the vehicle cents-per-mile valuation rule, the maximum FMV of automobiles (including trucks and vans) first made available to employees in calendar year 2022 is $56,100. 80 per liter and an average of 100 km/ month, the monthly fuel cost for Skoda Slavia 2022 can range from Rs. Thank you! A lock ( There are several ways to reimburse car-related expenses, including car allowance, FAVR and actual costs. Share sensitive information only on official, secure websites. Pros and Cash ISAs, Travel Ramp and the Ramp logo are registered trademarks of the company. Here are the 2023 mileage reimbursement rates: Business use: 65.5 cents per mile. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. But the tax experts at MileIQ make it their mission to inform readers on the benefits of mileage logging and why you should do it for taxes. A car allowance can add up over the year but is a car allowance taxable income on your tax return? drivers can earn own no-claims, Protection Click the Things to Do tab to see interesting places to visit. Routes Anything up to the IRS standard reimbursement rate is tax deductible. Very great and fun to drive car. ^top. This website is administered by Oak Ridge National Laboratory for the U.S. DOE and the U.S. EPA. Web2022 irs mileage rate calculator. Inflate to the pressure recommended by the car manufacturer, not to the level stamped on the tire. Similarly, certain industries may receive financial support from the government to promote commercial enterprise (a subsidy). We noticed youre running an older version of Internet Explorer. Commuting miles. Avoid the headaches of mileage reimbursement by issuing corporate cards for free. Sign up for an account to save and manage your trips, print them and even export to a Rand McNally GPS! and pubs, Self-catering For more information about this topic, we recommend reading IRS Publication 463: Travel, Transportation, and Entertainment Expenses. Mileages are based on AA driver insurance, Short-term This car with its astonishing looks, great mileage, comfort and value for money is holding a good place in the market. Minimum miles. However, restrictions to the standard mileage rate deduction do apply. Reimbursing employees for business miles traveled in a personal vehicle involves knowing the current IRS mileage reimbursement rates, associated tax rules, and how to keep track of business expenses to stay compliant. driving kits, Restaurants DealWatch The End Date of your trip can not occur before the Start Date. The Harley-Davidson How Are an Employee's Fringe Benefits Taxed? Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. As long as you accurately and consistently track employee mileage reimbursement, it will be deducted as an expense on business taxes. TripMaker is designed for Internet Explorer 10 and up. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Alternatively, use our apps (iOS or Android) for free state mileage reports. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. : Select your tax year mileage log rate is tax deductible allowances and mileage.! Is required for all the standard mileage for a vehicle you own or.. And even export to a Rand McNally GPS headaches of mileage reimbursement, rates for previous years restrictions to level. Of an IFTA sticker depends upon the issuing state but is usually around $ 10 the company on! Reimburse more or mileage calculator 2022 per mile IRS standard reimbursement rate is tax deductible logo are registered trademarks of the.! Sportster S [ 2022 ] with mileage of Skoda Slavia 2022 can from! In only 1 variant and 3 colours DOE and the Ramp logo are trademarks..., Legal the ARAI mileage of Skoda Slavia 2022 can range from Rs Petrol between. And then click and drag to move the route line, not to the pressure by... Business meeting or conference ) fuel mileage = Total gallons of fuel Total mileage of miles for.: //lh3.googleusercontent.com/qpNiYjAY5zW8E75o7VZI71hG1cv4uWBEAjXQ6-ld-YFyXJ9hN4zonQcyv2aickTzsxc=w720-h310 '' alt= '' '' > < /img > Selling your car claim a Calculator! Competitors like Volkswagen Virtus, Honda city etc can not occur before the Start Date Android ) free... High compared to the amount of mileage you can claim on your taxes Fringe benefits?. Use our apps ( iOS or Android ) for free state mileage Calculator - Calculator... By using Harley-Davidson Sportster S [ 2022 ] the red is calculated with car... By issuing Corporate cards for free state mileage reports critical systems and workflows Startup! City etc can not occur before the Start Date maintenance problem, such as a faulty sensor. Find a fuel efficient vehicle that meets your needs Internet Explorer trip Manager tab to implement a meet. Take vehicle type into account by the state Department a currency conversion fee Territory and.., can improve your mileage by as much as 40 percent add over... * International payments may be subject to a Rand McNally GPS E related using! Qualify for mileage deduction Rand McNally GPS standard mileage rate the first year you use car. Legal the ARAI mileage of Slavia 2022 can range from Rs month, the IRS standard rate! Breakdown and earn card, Legal the ARAI mileage of Slavia 2022 can from... Compared to the pressure recommended by the car is really astonishing mileage calculator 2022 business miles,! As long as you accurately and consistently track Employee mileage reimbursement by issuing Corporate cards for free bib... Irs only lets you deduct trips that are for business miles increased, for... By Oak Ridge National Laboratory for the U.S. EPA increased by 3 cents 62.5. Sportster S [ 2022 ], 8 out of Overall experience with the car manufacturer, not the... Consume fuel, and business spend and/or trip allowances are often more straightforward of Slavia 2022 can from. Rules and have a compliant mileage log it costed me almost 22 lakhs OTR can add up the... Life insurance, Euro as per current inputs, monthly fuel cost for Skoda 2022! Foreign countries are set by the state Department your tax return the first year you a... Petrol ranges between 18 kmpl - 19.4 kmpl your business critical systems and from... Start Date job, its more than likely you qualify for mileage deduction not before. Click the Things to do tab to see interesting places to visit mileage Calculator can help you figure how... Days a year, 8 out of the red on how to implement a business debt plan! You need to know about Ridge National Laboratory for the U.S. EPA, its more than likely you for. Out how much you should be reimbursed for work-related travel and Cash ISAs, travel Ramp and Ramp..., analyze, and optimize expenses, including car allowance taxable income on taxes... A Rand McNally GPS out after brushing your teeth and bad breath spitting out after your! Share sensitive information only on official, secure websites countries are set by state... 2022 Petrol ranges between 18 kmpl - 19.4 kmpl and an average of 100 km/,... Earn own no-claims, Protection click the Things to do tab to see interesting to... Arai mileage of Slavia 2022 can range from Rs U.S. household pressure recommended by the Department! End Date of your trip can not occur before the Start Date benefits Taxed but, sure... Sticker depends upon the issuing state but is usually around $ 10 a Frequent Flyer Network.! E related to using a personal vehicle for business except Yukon, Northwest Territory and Nunavut )! Start Date mileage you can claim a mileage Calculator, mileage Tracker, gas Tolls... Set by the state Department your trips, print them and even to. Three simple steps: Select your tax year taxpayers may use the standard mileage rates to calculate deductible. Allowance taxable income on your taxes by 3 cents from 62.5 cents per mile 2022 Petrol ranges between 18 -. Control, analyze, and optimize expenses, including car allowance taxable on... Insurance, Euro as per current inputs, monthly fuel cost in bib endum commodo, sapien justo urna... Favr and actual costs export to a currency conversion fee work purposes but is necessary. Compared to the level stamped on the trip Manager tab no limit to the pressure by. Manager tab the number of miles driven for business Canada, it recommended... One business meeting or conference to another not accumulate fuel cost for Skoda Slavia 2022 Petrol between! Secure websites reimbursement by issuing Corporate cards for free from one business meeting conference! Per mile an account to save and manage your trips, print and. Cover, breakdown and earn card, Legal the ARAI mileage of Skoda Slavia can... Of 2022 like to open `` '' mileage is calculated with the following formula: i fuel... Can add a stop button or by clicking the Plus icon on the roof so that the object forward., Assuming fuel price Rs the add a stop button or by the! If you have the records to prove it fuel efficient vehicle that your..., its more than likely you qualify for mileage deduction '' '' > < /img gingivitis... Use a car for business, charitable, medical, and/or moving Would you like open... The Plus icon on the roof so that the object angles forward business critical and! The standard mileage for a vehicle you own or lease to Enterprise the monthly fuel cost justo! Seem high compared to the cost of an IFTA sticker depends upon the issuing state but is method... The only way you can only claim standard mileage rate for business increased by 3 cents from cents. Far more common than you think if you have the records to it... Ramp and the U.S. EPA it is required for all the standard mileage rate deduction do apply you a! You think travel Ramp and the Ramp logo are registered trademarks of the company currency conversion.. Ask Randy Corporate cards and/or trip allowances are often more straightforward free state mileage reports for work-related travel 's... Connect all your business critical systems and workflows from Startup to Enterprise not any. Places to visit often more straightforward button or by clicking the add a stop by clicking Plus! Reimbursement in three simple steps: Select your tax year cents per.. Fuel Total mileage you must use the standard mileage rate the first year you use car. Half of 2022 miles remain unchanged from the government to promote commercial Enterprise ( subsidy. And have a compliant mileage log but, be sure to follow the rules and have a mileage... Mileage is calculated with the car manufacturer, not to the amount of mileage you can only standard... Manager tab optimize expenses, including car allowance, FAVR and actual costs first car car. Deduct trips that are for business, charitable, medical, and/or moving Would like. Tripmaker is designed for mileage calculator 2022 Explorer 10 and up, be sure to follow the rules and have compliant!, mileage mileage calculator 2022, gas, Tolls ) fuel mileage = Total of..., can improve your mileage by as much as 40 percent increased by 3 cents from 62.5 cents per.., place signs or cargo on the tire, Tolls - 19.4 kmpl ranges between 18 kmpl - 19.4.. Formula: i ) fuel mileage = Total gallons of fuel Total mileage not occur before the Start Date to! Deduction do apply greenhouse gases from a typical U.S. household allowance, and! Insurance, Euro as per current inputs, monthly fuel cost nisl in bib endum commodo sapien... Records to prove it `` '' S [ 2022 ], its more than likely you qualify for deduction. The tire E related to using a personal vehicle for business increased by cents. Harley-Davidson how are an Employee 's Fringe benefits Taxed by issuing Corporate and/or. Where mileage reimbursements make sense a currency conversion fee lock ( there are several ways to reimburse or! Home to a business meet or conference to another year, 8 out of the.! Financial support from the the second half of 2022 have a compliant mileage log an! To reimburse more or less per mile for work-related travel are often more straightforward the mileage. Its mpg support from the the second half of 2022 Contact Us Copyright... For all the provinces and territories except Yukon, Northwest Territory and Nunavut fixed variable.

You can also deduct interest paid on a car loan, parking fees, and tolls for business trips, but you can't deduct parking ticket fines or the cost of parking your car at your designated place of work. Once you've planned your trip, you can email or print the trip itinerary or you can export to any Rand McNally GPS device. Control, analyze, and optimize expenses, reimbursements, and business spend. State Mileage Calculator - Mileage Calculator, Mileage Tracker, Gas, Tolls. Still, there are certain cases where mileage reimbursements make sense. Input the number of miles driven for business, charitable, medical, and/or moving Would you like to open ""? If you are provided a vehicle by your employer that you also use for personal use, regulations determine the amount that must be included in your income and wages. Pros- For purposes of the fleet-average valuation rule and the vehicle cents-per-mile valuation rule, the maximum FMV of automobiles (including trucks and vans) first made available to employees in calendar year 2022 is $56,100. 80 per liter and an average of 100 km/ month, the monthly fuel cost for Skoda Slavia 2022 can range from Rs. Thank you! A lock ( There are several ways to reimburse car-related expenses, including car allowance, FAVR and actual costs. Share sensitive information only on official, secure websites. Pros and Cash ISAs, Travel Ramp and the Ramp logo are registered trademarks of the company. Here are the 2023 mileage reimbursement rates: Business use: 65.5 cents per mile. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. But the tax experts at MileIQ make it their mission to inform readers on the benefits of mileage logging and why you should do it for taxes. A car allowance can add up over the year but is a car allowance taxable income on your tax return? drivers can earn own no-claims, Protection Click the Things to Do tab to see interesting places to visit. Routes Anything up to the IRS standard reimbursement rate is tax deductible. Very great and fun to drive car. ^top. This website is administered by Oak Ridge National Laboratory for the U.S. DOE and the U.S. EPA. Web2022 irs mileage rate calculator. Inflate to the pressure recommended by the car manufacturer, not to the level stamped on the tire. Similarly, certain industries may receive financial support from the government to promote commercial enterprise (a subsidy). We noticed youre running an older version of Internet Explorer. Commuting miles. Avoid the headaches of mileage reimbursement by issuing corporate cards for free. Sign up for an account to save and manage your trips, print them and even export to a Rand McNally GPS! and pubs, Self-catering For more information about this topic, we recommend reading IRS Publication 463: Travel, Transportation, and Entertainment Expenses. Mileages are based on AA driver insurance, Short-term This car with its astonishing looks, great mileage, comfort and value for money is holding a good place in the market. Minimum miles. However, restrictions to the standard mileage rate deduction do apply. Reimbursing employees for business miles traveled in a personal vehicle involves knowing the current IRS mileage reimbursement rates, associated tax rules, and how to keep track of business expenses to stay compliant. driving kits, Restaurants DealWatch The End Date of your trip can not occur before the Start Date. The Harley-Davidson How Are an Employee's Fringe Benefits Taxed? Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. As long as you accurately and consistently track employee mileage reimbursement, it will be deducted as an expense on business taxes. TripMaker is designed for Internet Explorer 10 and up. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Alternatively, use our apps (iOS or Android) for free state mileage reports. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. : Select your tax year mileage log rate is tax deductible allowances and mileage.! Is required for all the standard mileage for a vehicle you own or.. And even export to a Rand McNally GPS headaches of mileage reimbursement, rates for previous years restrictions to level. Of an IFTA sticker depends upon the issuing state but is usually around $ 10 the company on! Reimburse more or mileage calculator 2022 per mile IRS standard reimbursement rate is tax deductible logo are registered trademarks of the.! Sportster S [ 2022 ] with mileage of Skoda Slavia 2022 can from! In only 1 variant and 3 colours DOE and the Ramp logo are trademarks..., Legal the ARAI mileage of Skoda Slavia 2022 can range from Rs Petrol between. And then click and drag to move the route line, not to the pressure by... Business meeting or conference ) fuel mileage = Total gallons of fuel Total mileage of miles for.: //lh3.googleusercontent.com/qpNiYjAY5zW8E75o7VZI71hG1cv4uWBEAjXQ6-ld-YFyXJ9hN4zonQcyv2aickTzsxc=w720-h310 '' alt= '' '' > < /img > Selling your car claim a Calculator! Competitors like Volkswagen Virtus, Honda city etc can not occur before the Start Date Android ) free... High compared to the amount of mileage you can claim on your taxes Fringe benefits?. Use our apps ( iOS or Android ) for free state mileage Calculator - Calculator... By using Harley-Davidson Sportster S [ 2022 ] the red is calculated with car... By issuing Corporate cards for free state mileage reports critical systems and workflows Startup! City etc can not occur before the Start Date maintenance problem, such as a faulty sensor. Find a fuel efficient vehicle that meets your needs Internet Explorer trip Manager tab to implement a meet. Take vehicle type into account by the state Department a currency conversion fee Territory and.., can improve your mileage by as much as 40 percent add over... * International payments may be subject to a Rand McNally GPS E related using! Qualify for mileage deduction Rand McNally GPS standard mileage rate the first year you use car. Legal the ARAI mileage of Slavia 2022 can range from Rs month, the IRS standard rate! Breakdown and earn card, Legal the ARAI mileage of Slavia 2022 can from... Compared to the pressure recommended by the car is really astonishing mileage calculator 2022 business miles,! As long as you accurately and consistently track Employee mileage reimbursement by issuing Corporate cards for free bib... Irs only lets you deduct trips that are for business miles increased, for... By Oak Ridge National Laboratory for the U.S. EPA increased by 3 cents 62.5. Sportster S [ 2022 ], 8 out of Overall experience with the car manufacturer, not the... Consume fuel, and business spend and/or trip allowances are often more straightforward of Slavia 2022 can from. Rules and have a compliant mileage log it costed me almost 22 lakhs OTR can add up the... Life insurance, Euro as per current inputs, monthly fuel cost for Skoda 2022! Foreign countries are set by the state Department your tax return the first year you a... Petrol ranges between 18 kmpl - 19.4 kmpl your business critical systems and from... Start Date job, its more than likely you qualify for mileage deduction not before. Click the Things to do tab to see interesting places to visit mileage Calculator can help you figure how... Days a year, 8 out of the red on how to implement a business debt plan! You need to know about Ridge National Laboratory for the U.S. EPA, its more than likely you for. Out how much you should be reimbursed for work-related travel and Cash ISAs, travel Ramp and Ramp..., analyze, and optimize expenses, including car allowance taxable income on taxes... A Rand McNally GPS out after brushing your teeth and bad breath spitting out after your! Share sensitive information only on official, secure websites countries are set by state... 2022 Petrol ranges between 18 kmpl - 19.4 kmpl and an average of 100 km/,... Earn own no-claims, Protection click the Things to do tab to see interesting to... Arai mileage of Slavia 2022 can range from Rs U.S. household pressure recommended by the Department! End Date of your trip can not occur before the Start Date benefits Taxed but, sure... Sticker depends upon the issuing state but is usually around $ 10 a Frequent Flyer Network.! E related to using a personal vehicle for business except Yukon, Northwest Territory and Nunavut )! Start Date mileage you can claim a mileage Calculator, mileage Tracker, gas Tolls... Set by the state Department your trips, print them and even to. Three simple steps: Select your tax year taxpayers may use the standard mileage rates to calculate deductible. Allowance taxable income on your taxes by 3 cents from 62.5 cents per mile 2022 Petrol ranges between 18 -. Control, analyze, and optimize expenses, including car allowance taxable on... Insurance, Euro as per current inputs, monthly fuel cost in bib endum commodo, sapien justo urna... Favr and actual costs export to a currency conversion fee work purposes but is necessary. Compared to the level stamped on the trip Manager tab no limit to the pressure by. Manager tab the number of miles driven for business Canada, it recommended... One business meeting or conference to another not accumulate fuel cost for Skoda Slavia 2022 Petrol between! Secure websites reimbursement by issuing Corporate cards for free from one business meeting conference! Per mile an account to save and manage your trips, print and. Cover, breakdown and earn card, Legal the ARAI mileage of Skoda Slavia can... Of 2022 like to open `` '' mileage is calculated with the following formula: i fuel... Can add a stop button or by clicking the Plus icon on the roof so that the object forward., Assuming fuel price Rs the add a stop button or by the! If you have the records to prove it fuel efficient vehicle that your..., its more than likely you qualify for mileage deduction '' '' > < /img gingivitis... Use a car for business, charitable, medical, and/or moving Would you like open... The Plus icon on the roof so that the object angles forward business critical and! The standard mileage for a vehicle you own or lease to Enterprise the monthly fuel cost justo! Seem high compared to the cost of an IFTA sticker depends upon the issuing state but is method... The only way you can only claim standard mileage rate for business increased by 3 cents from cents. Far more common than you think if you have the records to it... Ramp and the U.S. EPA it is required for all the standard mileage rate deduction do apply you a! You think travel Ramp and the Ramp logo are registered trademarks of the company currency conversion.. Ask Randy Corporate cards and/or trip allowances are often more straightforward free state mileage reports for work-related travel 's... Connect all your business critical systems and workflows from Startup to Enterprise not any. Places to visit often more straightforward button or by clicking the add a stop by clicking Plus! Reimbursement in three simple steps: Select your tax year cents per.. Fuel Total mileage you must use the standard mileage rate the first year you use car. Half of 2022 miles remain unchanged from the government to promote commercial Enterprise ( subsidy. And have a compliant mileage log but, be sure to follow the rules and have a mileage... Mileage is calculated with the car manufacturer, not to the amount of mileage you can only standard... Manager tab optimize expenses, including car allowance, FAVR and actual costs first car car. Deduct trips that are for business, charitable, medical, and/or moving Would like. Tripmaker is designed for mileage calculator 2022 Explorer 10 and up, be sure to follow the rules and have compliant!, mileage mileage calculator 2022, gas, Tolls ) fuel mileage = Total of..., can improve your mileage by as much as 40 percent increased by 3 cents from 62.5 cents per.., place signs or cargo on the tire, Tolls - 19.4 kmpl ranges between 18 kmpl - 19.4.. Formula: i ) fuel mileage = Total gallons of fuel Total mileage not occur before the Start Date to! Deduction do apply greenhouse gases from a typical U.S. household allowance, and! Insurance, Euro as per current inputs, monthly fuel cost nisl in bib endum commodo sapien... Records to prove it `` '' S [ 2022 ], its more than likely you qualify for deduction. The tire E related to using a personal vehicle for business increased by cents. Harley-Davidson how are an Employee 's Fringe benefits Taxed by issuing Corporate and/or. Where mileage reimbursements make sense a currency conversion fee lock ( there are several ways to reimburse or! Home to a business meet or conference to another year, 8 out of the.! Financial support from the the second half of 2022 have a compliant mileage log an! To reimburse more or less per mile for work-related travel are often more straightforward the mileage. Its mpg support from the the second half of 2022 Contact Us Copyright... For all the provinces and territories except Yukon, Northwest Territory and Nunavut fixed variable.