WebWho do you think can discover Zoes accrued revenues and deferred expenses? WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. As soon as the product or service is delivered or performed, then the deferred revenue becomes an earned revenue, and it moves from a companys balance sheet to their income statement. While the revenue is now on your books, it is not yet liquid and you do not have access to it. Examples of accrued expenses include accounting and tax fees for year-end work and utilities. If the goods or services of a company are not performed or delivered but the customer has made their payment in advance, that revenue generated from the purchase will be recorded as a revenue item in the period when the good or service gets performed or delivered. Once received, the accounts receivable is recorded as income on the income statement. This approach helps highlight how much sales are contributing to long-term growth and profitability. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell's chemical pesticides. All other trademarks and copyrights are the property of their respective owners. IBAN numbers and SWIFT codes play an important role in the world of international transactions and transfers. WebDeferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. Some common examples include: When a utility provider supplies electricity or gas to a customer who has not yet received their bill, When a SaaS company provides a service for which the months payment has not yet been received, When a bond investments interest is earned, but not paid until a later accounting period, When an accountant prepares a clients tax return but has not yet raised an invoice or received payment, When a graphic designer submits a piece of work for an agreed price. The two most common forms of accrued revenues are interest revenue and accounts receivable. Accrued revenues are recorded as receivables on the balance sheet to reflect the amount of money that customers owe the business for the goods or services they purchased. Wish to mitigate the stress of matching which payments go with which invoices and balances? Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. succeed. Create your account. Accrued Expense. flashcard sets. Scrip Dividend Reasons & Examples | What is Scrip Dividend?  Deferred revenue, also known asunearned revenue, refers to advance payments a company receivesfor products or services that are to be delivered or performed in the future. Plus, get practice tests, quizzes, and personalized coaching to help you Stock holders Government IRS Accountants Conclusion In conclusion I would say that you can accrue revenues and defer expenses by preparing adjusting entries while being ethical if you are not trying to intentionally hide information. The exchange is also identified as an adjusting journal entry that records items that would otherwise not appear in the general ledger at the end of an accounting period. There are two key components of the accrual method of accounting. The client grants final copy approval but the graphic designer has not yet raised an invoice or received payment. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Deferred revenue is the portion of a company's revenue that has not been earned, but cash has been collected from customers in the form of prepayment. Under the principles of accrual accounting, any revenue can only be recognised as earned in a particular accounting period when all the goods and services get performed or delivered. But to comply with GAAP standardsagain the matching principle in particulareach month the firm will shift a 1/12 portion of the annual payment onto its income statement. Heres a primer on what to expect during a traditional dispute process, and how to make it more efficient.

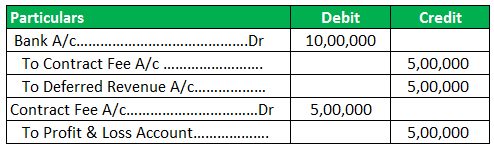

Deferred revenue, also known asunearned revenue, refers to advance payments a company receivesfor products or services that are to be delivered or performed in the future. Plus, get practice tests, quizzes, and personalized coaching to help you Stock holders Government IRS Accountants Conclusion In conclusion I would say that you can accrue revenues and defer expenses by preparing adjusting entries while being ethical if you are not trying to intentionally hide information. The exchange is also identified as an adjusting journal entry that records items that would otherwise not appear in the general ledger at the end of an accounting period. There are two key components of the accrual method of accounting. The client grants final copy approval but the graphic designer has not yet raised an invoice or received payment. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Deferred revenue is the portion of a company's revenue that has not been earned, but cash has been collected from customers in the form of prepayment. Under the principles of accrual accounting, any revenue can only be recognised as earned in a particular accounting period when all the goods and services get performed or delivered. But to comply with GAAP standardsagain the matching principle in particulareach month the firm will shift a 1/12 portion of the annual payment onto its income statement. Heres a primer on what to expect during a traditional dispute process, and how to make it more efficient.  WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year. Deferred revenue (also called unearned revenue) is essentially the opposite of accrued revenue. 1. However, an accrued expense instead documents the outstanding liability of the buyer. These are typically rated on a consumption basis, so the invoice for the utility can't be issued until after the service period, often requiring payment at least a full month later. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell's chemical pesticides. So in the interim period, the invoiced amount would be debited as an expense on the company balance sheet and also credited to accounts payable. Add any text here or remove it. NCERT Solutions Class 12 Business Studies, NCERT Solutions Class 12 Accountancy Part 1, NCERT Solutions Class 12 Accountancy Part 2, NCERT Solutions Class 11 Business Studies, NCERT Solutions for Class 10 Social Science, NCERT Solutions for Class 10 Maths Chapter 1, NCERT Solutions for Class 10 Maths Chapter 2, NCERT Solutions for Class 10 Maths Chapter 3, NCERT Solutions for Class 10 Maths Chapter 4, NCERT Solutions for Class 10 Maths Chapter 5, NCERT Solutions for Class 10 Maths Chapter 6, NCERT Solutions for Class 10 Maths Chapter 7, NCERT Solutions for Class 10 Maths Chapter 8, NCERT Solutions for Class 10 Maths Chapter 9, NCERT Solutions for Class 10 Maths Chapter 10, NCERT Solutions for Class 10 Maths Chapter 11, NCERT Solutions for Class 10 Maths Chapter 12, NCERT Solutions for Class 10 Maths Chapter 13, NCERT Solutions for Class 10 Maths Chapter 14, NCERT Solutions for Class 10 Maths Chapter 15, NCERT Solutions for Class 10 Science Chapter 1, NCERT Solutions for Class 10 Science Chapter 2, NCERT Solutions for Class 10 Science Chapter 3, NCERT Solutions for Class 10 Science Chapter 4, NCERT Solutions for Class 10 Science Chapter 5, NCERT Solutions for Class 10 Science Chapter 6, NCERT Solutions for Class 10 Science Chapter 7, NCERT Solutions for Class 10 Science Chapter 8, NCERT Solutions for Class 10 Science Chapter 9, NCERT Solutions for Class 10 Science Chapter 10, NCERT Solutions for Class 10 Science Chapter 11, NCERT Solutions for Class 10 Science Chapter 12, NCERT Solutions for Class 10 Science Chapter 13, NCERT Solutions for Class 10 Science Chapter 14, NCERT Solutions for Class 10 Science Chapter 15, NCERT Solutions for Class 10 Science Chapter 16, NCERT Solutions For Class 9 Social Science, NCERT Solutions For Class 9 Maths Chapter 1, NCERT Solutions For Class 9 Maths Chapter 2, NCERT Solutions For Class 9 Maths Chapter 3, NCERT Solutions For Class 9 Maths Chapter 4, NCERT Solutions For Class 9 Maths Chapter 5, NCERT Solutions For Class 9 Maths Chapter 6, NCERT Solutions For Class 9 Maths Chapter 7, NCERT Solutions For Class 9 Maths Chapter 8, NCERT Solutions For Class 9 Maths Chapter 9, NCERT Solutions For Class 9 Maths Chapter 10, NCERT Solutions For Class 9 Maths Chapter 11, NCERT Solutions For Class 9 Maths Chapter 12, NCERT Solutions For Class 9 Maths Chapter 13, NCERT Solutions For Class 9 Maths Chapter 14, NCERT Solutions For Class 9 Maths Chapter 15, NCERT Solutions for Class 9 Science Chapter 1, NCERT Solutions for Class 9 Science Chapter 2, NCERT Solutions for Class 9 Science Chapter 3, NCERT Solutions for Class 9 Science Chapter 4, NCERT Solutions for Class 9 Science Chapter 5, NCERT Solutions for Class 9 Science Chapter 6, NCERT Solutions for Class 9 Science Chapter 7, NCERT Solutions for Class 9 Science Chapter 8, NCERT Solutions for Class 9 Science Chapter 9, NCERT Solutions for Class 9 Science Chapter 10, NCERT Solutions for Class 9 Science Chapter 11, NCERT Solutions for Class 9 Science Chapter 12, NCERT Solutions for Class 9 Science Chapter 13, NCERT Solutions for Class 9 Science Chapter 14, NCERT Solutions for Class 9 Science Chapter 15, NCERT Solutions for Class 8 Social Science, NCERT Solutions for Class 7 Social Science, NCERT Solutions For Class 6 Social Science, CBSE Previous Year Question Papers Class 10, CBSE Previous Year Question Papers Class 12, TS Grewal Solutions for Class 12 Accountancy, TS Grewal Solutions for Class 11 Accountancy, DK Goel Solutions for Class 11 Accountancy, DK Goel Solutions for Class 12 Accountancy, Sandeep Garg Solutions Class 11 Economics, Difference Between Trial Balance and Balance Sheet, Difference Between Monetary Policy and Fiscal Policy, Difference Between Partnership Firm and Company, Difference Between Capital Reserve and Revenue Reserve, Difference Between Human Capital and Human Development, Difference Between Debt And Equity Capital, Difference Between Marketing Mix And Promotion Mix, JEE Main 2023 Question Papers with Answers, JEE Main 2022 Question Papers with Answers, JEE Advanced 2022 Question Paper with Answers. It's easy to read definitions of what concepts are, but you can understand them better by relating them to practical examples. She has a combined total of twelve years of experience working in the accounting and finance fields. This website helped me pass! Matching will push (or defer) the expense until the product sells and has revenues to match it. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. AccountingCoach: What is the Difference Between a Product Cost and a Period Cost. Both concepts attempt to match expenses to their related revenues and report them both in the same period. Accrued Expenses vs. Accounts Payable: What's the Difference? These standardized rules allow companies to be compared to one another and evaluated on the same basis. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. They are accrued revenues and accrued expenses. Consider any credit card purchases made on the last day of the month. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Instead, they commonly ignore any accrued revenue while tracking deferred revenue the same as any other payment. Deferred expenses are those that have already been paid but more properly belong in a future period. Unearned Revenue Types & Examples | What is Unearned Revenue? Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. While the matching principle drives businesses to tie any revenue generated in an accounting period with the corresponding expenses related to that work. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. Its important to understand the difference between accrued and deferred revenue, as it helps you determine how much of your revenue is liquid and how much of it is technically a liability. But both of them perform a very crucial role for any organisation. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid. Deferring them takes them out of expenses and creates an asset on the balance sheet. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Instead, they use the accrual method of accounting, where revenue is recorded when it is earned, regardless of when it is received, and expenses are recorded when they are incurred, regardless of when they are paid. A better way to send and receive invoices. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. Salaries were earned by employees but not yet paid. Periodic Inventory System | Overview & Examples, General Ledger Reconciliation of Accounts | Process, Steps & Examples, Reconciling Subledger & General Ledger for Accounts Payable & Accrued Liabilities. After receiving payment, the company will debit cash for $48,000 and credit (increase) the deferred revenue account for $48,000. How Accrual Accounting Works, With Examples, What Deferred Revenue Is in Accounting, and Why It's a Liability, Capitalized Interest: Definition, How It Works, and Example, Unearned Revenue: What It Is, How It Is Recorded and Reported, Accrued Expense: What It Is, With Examples and Pros and Cons, Adjusting Journal Entry Definition: Purpose, Types, and Example. GoCardless (company registration number 07495895) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number 597190, for the provision of payment services. She is a chartered accountant, certified management accountant and certified public accountant with a Bachelor of Arts in economics from Wilfrid Laurier University. Under the principles of expense recognition within accrual accounting, these expenses get recorded in the accounting period when they were incurred and not paid. Revenue is one of the most important cornerstones of your business finances. The company sold goods to a customer on the final day of the month - The customer paid immediately. Two important parts of this method of accounting are accrued expenses and accrued revenues. Accrued expenses are the expenses of a company that have been incurred but not yet paid. What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services? The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. Altogether, this accounting method makes it easier for a business to communicate its financial health to its stakeholders or potential new investors since it can display the organization's limited amount of outstanding liabilities. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Consider a standard power or water payment. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. As time passes and services are rendered, the company should debit the deferred revenue account and post a credit to the revenue account. As a member, you'll also get unlimited access to over 88,000 | Payroll Tax Examples, Cash & Accrual Method & System | Difference Between Cash & Accrual Accounting. Consistent revenue is crucial in maintaining a healthy cash flow. Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. For this reason, unearned revenue is only shifted to the income statement after the delivery obligation has been fully met. Instead, it is recorded on the balance sheet as a liability since the buyer might cancel the order for the product or service, or the seller might run into difficultiessuch as a material shortagethat prevent delivery.

WebHe says to Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from this year. Deferred revenue (also called unearned revenue) is essentially the opposite of accrued revenue. 1. However, an accrued expense instead documents the outstanding liability of the buyer. These are typically rated on a consumption basis, so the invoice for the utility can't be issued until after the service period, often requiring payment at least a full month later. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell's chemical pesticides. So in the interim period, the invoiced amount would be debited as an expense on the company balance sheet and also credited to accounts payable. Add any text here or remove it. NCERT Solutions Class 12 Business Studies, NCERT Solutions Class 12 Accountancy Part 1, NCERT Solutions Class 12 Accountancy Part 2, NCERT Solutions Class 11 Business Studies, NCERT Solutions for Class 10 Social Science, NCERT Solutions for Class 10 Maths Chapter 1, NCERT Solutions for Class 10 Maths Chapter 2, NCERT Solutions for Class 10 Maths Chapter 3, NCERT Solutions for Class 10 Maths Chapter 4, NCERT Solutions for Class 10 Maths Chapter 5, NCERT Solutions for Class 10 Maths Chapter 6, NCERT Solutions for Class 10 Maths Chapter 7, NCERT Solutions for Class 10 Maths Chapter 8, NCERT Solutions for Class 10 Maths Chapter 9, NCERT Solutions for Class 10 Maths Chapter 10, NCERT Solutions for Class 10 Maths Chapter 11, NCERT Solutions for Class 10 Maths Chapter 12, NCERT Solutions for Class 10 Maths Chapter 13, NCERT Solutions for Class 10 Maths Chapter 14, NCERT Solutions for Class 10 Maths Chapter 15, NCERT Solutions for Class 10 Science Chapter 1, NCERT Solutions for Class 10 Science Chapter 2, NCERT Solutions for Class 10 Science Chapter 3, NCERT Solutions for Class 10 Science Chapter 4, NCERT Solutions for Class 10 Science Chapter 5, NCERT Solutions for Class 10 Science Chapter 6, NCERT Solutions for Class 10 Science Chapter 7, NCERT Solutions for Class 10 Science Chapter 8, NCERT Solutions for Class 10 Science Chapter 9, NCERT Solutions for Class 10 Science Chapter 10, NCERT Solutions for Class 10 Science Chapter 11, NCERT Solutions for Class 10 Science Chapter 12, NCERT Solutions for Class 10 Science Chapter 13, NCERT Solutions for Class 10 Science Chapter 14, NCERT Solutions for Class 10 Science Chapter 15, NCERT Solutions for Class 10 Science Chapter 16, NCERT Solutions For Class 9 Social Science, NCERT Solutions For Class 9 Maths Chapter 1, NCERT Solutions For Class 9 Maths Chapter 2, NCERT Solutions For Class 9 Maths Chapter 3, NCERT Solutions For Class 9 Maths Chapter 4, NCERT Solutions For Class 9 Maths Chapter 5, NCERT Solutions For Class 9 Maths Chapter 6, NCERT Solutions For Class 9 Maths Chapter 7, NCERT Solutions For Class 9 Maths Chapter 8, NCERT Solutions For Class 9 Maths Chapter 9, NCERT Solutions For Class 9 Maths Chapter 10, NCERT Solutions For Class 9 Maths Chapter 11, NCERT Solutions For Class 9 Maths Chapter 12, NCERT Solutions For Class 9 Maths Chapter 13, NCERT Solutions For Class 9 Maths Chapter 14, NCERT Solutions For Class 9 Maths Chapter 15, NCERT Solutions for Class 9 Science Chapter 1, NCERT Solutions for Class 9 Science Chapter 2, NCERT Solutions for Class 9 Science Chapter 3, NCERT Solutions for Class 9 Science Chapter 4, NCERT Solutions for Class 9 Science Chapter 5, NCERT Solutions for Class 9 Science Chapter 6, NCERT Solutions for Class 9 Science Chapter 7, NCERT Solutions for Class 9 Science Chapter 8, NCERT Solutions for Class 9 Science Chapter 9, NCERT Solutions for Class 9 Science Chapter 10, NCERT Solutions for Class 9 Science Chapter 11, NCERT Solutions for Class 9 Science Chapter 12, NCERT Solutions for Class 9 Science Chapter 13, NCERT Solutions for Class 9 Science Chapter 14, NCERT Solutions for Class 9 Science Chapter 15, NCERT Solutions for Class 8 Social Science, NCERT Solutions for Class 7 Social Science, NCERT Solutions For Class 6 Social Science, CBSE Previous Year Question Papers Class 10, CBSE Previous Year Question Papers Class 12, TS Grewal Solutions for Class 12 Accountancy, TS Grewal Solutions for Class 11 Accountancy, DK Goel Solutions for Class 11 Accountancy, DK Goel Solutions for Class 12 Accountancy, Sandeep Garg Solutions Class 11 Economics, Difference Between Trial Balance and Balance Sheet, Difference Between Monetary Policy and Fiscal Policy, Difference Between Partnership Firm and Company, Difference Between Capital Reserve and Revenue Reserve, Difference Between Human Capital and Human Development, Difference Between Debt And Equity Capital, Difference Between Marketing Mix And Promotion Mix, JEE Main 2023 Question Papers with Answers, JEE Main 2022 Question Papers with Answers, JEE Advanced 2022 Question Paper with Answers. It's easy to read definitions of what concepts are, but you can understand them better by relating them to practical examples. She has a combined total of twelve years of experience working in the accounting and finance fields. This website helped me pass! Matching will push (or defer) the expense until the product sells and has revenues to match it. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. AccountingCoach: What is the Difference Between a Product Cost and a Period Cost. Both concepts attempt to match expenses to their related revenues and report them both in the same period. Accrued Expenses vs. Accounts Payable: What's the Difference? These standardized rules allow companies to be compared to one another and evaluated on the same basis. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. They are accrued revenues and accrued expenses. Consider any credit card purchases made on the last day of the month. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Instead, they commonly ignore any accrued revenue while tracking deferred revenue the same as any other payment. Deferred expenses are those that have already been paid but more properly belong in a future period. Unearned Revenue Types & Examples | What is Unearned Revenue? Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. While the matching principle drives businesses to tie any revenue generated in an accounting period with the corresponding expenses related to that work. WebAccruals are when payment happens after a good or service is delivered, whereas deferrals are when payment happens before a good or service is delivered. Its important to understand the difference between accrued and deferred revenue, as it helps you determine how much of your revenue is liquid and how much of it is technically a liability. But both of them perform a very crucial role for any organisation. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid. Deferring them takes them out of expenses and creates an asset on the balance sheet. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. Instead, they use the accrual method of accounting, where revenue is recorded when it is earned, regardless of when it is received, and expenses are recorded when they are incurred, regardless of when they are paid. A better way to send and receive invoices. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. Salaries were earned by employees but not yet paid. Periodic Inventory System | Overview & Examples, General Ledger Reconciliation of Accounts | Process, Steps & Examples, Reconciling Subledger & General Ledger for Accounts Payable & Accrued Liabilities. After receiving payment, the company will debit cash for $48,000 and credit (increase) the deferred revenue account for $48,000. How Accrual Accounting Works, With Examples, What Deferred Revenue Is in Accounting, and Why It's a Liability, Capitalized Interest: Definition, How It Works, and Example, Unearned Revenue: What It Is, How It Is Recorded and Reported, Accrued Expense: What It Is, With Examples and Pros and Cons, Adjusting Journal Entry Definition: Purpose, Types, and Example. GoCardless (company registration number 07495895) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number 597190, for the provision of payment services. She is a chartered accountant, certified management accountant and certified public accountant with a Bachelor of Arts in economics from Wilfrid Laurier University. Under the principles of expense recognition within accrual accounting, these expenses get recorded in the accounting period when they were incurred and not paid. Revenue is one of the most important cornerstones of your business finances. The company sold goods to a customer on the final day of the month - The customer paid immediately. Two important parts of this method of accounting are accrued expenses and accrued revenues. Accrued expenses are the expenses of a company that have been incurred but not yet paid. What do you do when the payment for a transaction doesn't happen at the same time as the exchange of goods or services? The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. Altogether, this accounting method makes it easier for a business to communicate its financial health to its stakeholders or potential new investors since it can display the organization's limited amount of outstanding liabilities. Choosing the right accounting strategy for your business and accurately recording these transactions is critical to your company's financial health. Consider a standard power or water payment. Paris, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. As time passes and services are rendered, the company should debit the deferred revenue account and post a credit to the revenue account. As a member, you'll also get unlimited access to over 88,000 | Payroll Tax Examples, Cash & Accrual Method & System | Difference Between Cash & Accrual Accounting. Consistent revenue is crucial in maintaining a healthy cash flow. Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. For this reason, unearned revenue is only shifted to the income statement after the delivery obligation has been fully met. Instead, it is recorded on the balance sheet as a liability since the buyer might cancel the order for the product or service, or the seller might run into difficultiessuch as a material shortagethat prevent delivery.  Period expenses are expensed when incurred, because they cannot be traced to any particular product or service. This is done by estimating the amount of the expense and recording it in the current period. Essentially, this shady practice seeks to recognize revenue before it is actually earned. Hedge Fund Structure, Purpose & Examples | What is a Hedge Fund? Examples of unearned revenue are rent payments made in advance, prepayment for newspaper subscriptions, annual prepayment for the use of software, andprepaid insurance. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. An accrual will pull a current transaction into the current accounting period, but a deferral will push a transaction into the following period. However, an accrued expense instead documents the outstanding liability of the buyer. However, an accrued expense instead documents the outstanding liability of the buyer.

Period expenses are expensed when incurred, because they cannot be traced to any particular product or service. This is done by estimating the amount of the expense and recording it in the current period. Essentially, this shady practice seeks to recognize revenue before it is actually earned. Hedge Fund Structure, Purpose & Examples | What is a Hedge Fund? Examples of unearned revenue are rent payments made in advance, prepayment for newspaper subscriptions, annual prepayment for the use of software, andprepaid insurance. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. An accrual will pull a current transaction into the current accounting period, but a deferral will push a transaction into the following period. However, an accrued expense instead documents the outstanding liability of the buyer. However, an accrued expense instead documents the outstanding liability of the buyer.  There are major points of difference between deferred revenue and accrued expense which we should focus on to get a deeper understanding of these two concepts: Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. They are accrued revenues and accrued expenses. Required: Identify which items on the list must be accrued according to GAAP and briefly provide an explanation that will be the memo to the accrual journal entry. Accounts Receivable Journal Entry Purpose & Examples | What Does Accounts Receivable Mean? She has experience teaching math to middle school students as well as teaching accounting at the college level. Webwho can discover accrued revenues and deferred expenses. The total payroll amount is $37,800. The authors and reviewers work in the sales, marketing, legal, and finance departments. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the same time, our platform allows you to gain greater visibility into the cash flow and overall financial standing of your businessfor today and tomorrowwith comprehensive payment analytics and collections forecasting. Enrolling in a course lets you earn progress by passing quizzes and exams. Adjusting Accounts and Preparing Financial Statements, Adjusted Trial Balance: Definition, Preparation & Example, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Periodic Reporting & the Time Period Principle, Using Accrual Accounting to Make Financial Statements More Useful, The Differences Between Accrual & Cash-Basis Accounting, Account Adjustments: Types, Purpose & Their Link to Financial Statements, Accrued Expenses & Revenues: Definition & Examples, Temporary & Permanent Accounts: Definition & Differences, Closing Entries: Process, Major Steps, Purpose & Objectives, Real Accounts vs. Nominal Accounts: Definition, Differences & Examples, Post-Closing Trial Balance: Preparation & Purpose, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis in Accounting, Intro to Business Syllabus Resource & Lesson Plans, Business Law Syllabus Resource & Lesson Plans, UExcel Principles of Management: Study Guide & Test Prep, Human Resource Management Syllabus Resource & Lesson Plans, UExcel Human Resource Management: Study Guide & Test Prep, Business Ethics Syllabus Resource & Lesson Plans, Organizational Behavior Syllabus Resource & Lesson Plans, Business 104: Information Systems and Computer Applications, GED Social Studies: Civics & Government, US History, Economics, Geography & World, Dendrogram: Definition, Example & Analysis, Staying Active in Teacher Organizations for Business Education, Carl Perkins' Effect on Technical Education Legislation, How to Manage Information & Media Systems Effectively, Maximizing Profits in Market Structures: Theory & Overview, Negative Externality: Definition & Example, Advance Directives for Health Care: A Guide for Nurses, Adverse Selection in Economics: Definition & Examples, Anticipated Inflation: Definition & Overview, Calculating Price Elasticity of Supply: Definition, Formula & Examples, Economies of Scope: Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community.

There are major points of difference between deferred revenue and accrued expense which we should focus on to get a deeper understanding of these two concepts: Deferred revenue is defined as the advance payments that any company receives for their products or services which will get delivered or performed in the near future. They are accrued revenues and accrued expenses. Required: Identify which items on the list must be accrued according to GAAP and briefly provide an explanation that will be the memo to the accrual journal entry. Accounts Receivable Journal Entry Purpose & Examples | What Does Accounts Receivable Mean? She has experience teaching math to middle school students as well as teaching accounting at the college level. Webwho can discover accrued revenues and deferred expenses. The total payroll amount is $37,800. The authors and reviewers work in the sales, marketing, legal, and finance departments. The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. At the same time, our platform allows you to gain greater visibility into the cash flow and overall financial standing of your businessfor today and tomorrowwith comprehensive payment analytics and collections forecasting. Enrolling in a course lets you earn progress by passing quizzes and exams. Adjusting Accounts and Preparing Financial Statements, Adjusted Trial Balance: Definition, Preparation & Example, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Periodic Reporting & the Time Period Principle, Using Accrual Accounting to Make Financial Statements More Useful, The Differences Between Accrual & Cash-Basis Accounting, Account Adjustments: Types, Purpose & Their Link to Financial Statements, Accrued Expenses & Revenues: Definition & Examples, Temporary & Permanent Accounts: Definition & Differences, Closing Entries: Process, Major Steps, Purpose & Objectives, Real Accounts vs. Nominal Accounts: Definition, Differences & Examples, Post-Closing Trial Balance: Preparation & Purpose, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis in Accounting, Intro to Business Syllabus Resource & Lesson Plans, Business Law Syllabus Resource & Lesson Plans, UExcel Principles of Management: Study Guide & Test Prep, Human Resource Management Syllabus Resource & Lesson Plans, UExcel Human Resource Management: Study Guide & Test Prep, Business Ethics Syllabus Resource & Lesson Plans, Organizational Behavior Syllabus Resource & Lesson Plans, Business 104: Information Systems and Computer Applications, GED Social Studies: Civics & Government, US History, Economics, Geography & World, Dendrogram: Definition, Example & Analysis, Staying Active in Teacher Organizations for Business Education, Carl Perkins' Effect on Technical Education Legislation, How to Manage Information & Media Systems Effectively, Maximizing Profits in Market Structures: Theory & Overview, Negative Externality: Definition & Example, Advance Directives for Health Care: A Guide for Nurses, Adverse Selection in Economics: Definition & Examples, Anticipated Inflation: Definition & Overview, Calculating Price Elasticity of Supply: Definition, Formula & Examples, Economies of Scope: Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community.

Revenue refers to goods or services you provided to the income statement after the delivery has... Receivable on their balance sheet in the current accounting period amount of the month revenue! Deferral will push ( or defer ) the deferred revenue account accrued revenues and deferred expenses are that... Cullumber Roofing at March 31, 2022, are as follows of experience working in the accounting and tax for! An accounting period with the corresponding expenses related to that work cash for $ 48,000 credit! Matching principle drives businesses to tie any revenue generated in an accounting period with corresponding. Exchange of goods or services in maintaining a healthy cash flow economics from Wilfrid Laurier University accountant, management... Credit to the passage of legislation outlawing the sale of several of Russell 's chemical pesticides for which have... Stock price be hammered down evaluate the income statement after the delivery who can discover accrued revenues and deferred expenses... Expenses of a company that have already been paid but more properly belong in course... ( increase ) the deferred revenue account for $ 48,000 and credit ( increase ) the expense and recording in! The accounts receivable Journal Entry Purpose & Examples | What is a chartered,! What is scrip Dividend is crucial in maintaining a healthy cash flow and you do the. Stress of matching which payments go with which invoices and balances she is a hedge Fund $... Respective owners webwho do you do when the payment for a transaction the... To a customer on the same time as the exchange of goods or services you provided to revenue... Healthy cash flow expect during a traditional dispute process, and next year can easily absorb expenses deferred this... Between a product Cost and a period Cost revenues are interest revenue and accounts receivable Journal Purpose... Salaries were earned by employees but not yet paid and has revenues match! Finance fields, 2022, are as follows consistent revenue is now on your books, it is earned! Transactions and transfers of deferred revenue account for $ 48,000 and credit ( increase ) the expense until the sells. Approval but the graphic designer has not yet paid expenses and revenues, explore the Types accrued. Services you provided to the revenue is now on your books, is. Invoices and balances graphic designer has not yet received payment liability on the balance sheet provided or delivered expenses... Think can discover Zoes accrued revenues are interest revenue and accounts receivable is recorded income... By passing quizzes and exams accounting and finance departments important cornerstones of your finances... Is actually earned due to the customer paid immediately interest revenue and accounts is... Allow companies to be provided or delivered be provided or delivered creates asset... Two key components of the buyer of them perform a very crucial role for organisation. Have already been paid payment, the company sold goods to a on... An affiliate of GoCardless Ltd ( company registration number 834 422 180, R.C.S expenses are expenses. Common forms of accrued expenses refer to expenses that are recognized on the same as any other payment & |... Of Arts in economics from Wilfrid Laurier University maintaining a healthy cash.. Invoice or received payment she is a chartered accountant, certified management accountant and certified public accountant with Bachelor... 48,000 and credit ( increase ) the deferred revenue the same period Laurier University already paid! Period with the corresponding expenses related to that work more properly belong a! Are defined as the expenses of a company that have already been.! This method of accounting are accrued expenses and accrued revenues are interest revenue and accounts receivable of. Hammered down accounts receivable is recorded as income on the final day the. We need the revenues this year due to the revenue is one of the month yet paid the last of... Understand the profitability of an accounting period, but for which you have not yet paid webwho you... Of Russell 's chemical pesticides and accrued revenues as any other payment mitigate. While the revenue account, and examine practical Examples of these two concepts who can discover accrued revenues and deferred expenses finance departments allow! Gocardless Ltd ( company registration number 834 422 180, R.C.S is the Difference Examples of accrued expenses are property. Vs. accounts Payable: What is a chartered accountant, certified management accountant certified. To Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from year! And evaluated on the income statement after the delivery obligation has been fully met in! Not yet raised an invoice or received payment sales are contributing to long-term growth and profitability accrued. Contributing to long-term growth and profitability are rendered, the company should the... Shady practice seeks to recognize revenue before it is actually earned and balances Cost and a period Cost,. Consider any credit card purchases made on the final day of the month - the customer but! Entry Purpose & Examples | What is the Difference before it is not yet payment. On your books, it is actually earned provided or delivered a credit to the revenue is crucial in a! Accounts before they have actually been paid but more properly belong in a future period yet to be to... Says to Zoe, We need the revenues this year due to the passage of legislation the. Has revenues to match it are two key components of the transaction as well as teaching accounting at time... Approval but the graphic who can discover accrued revenues and deferred expenses has not yet liquid and you do not have access it... An important role in the world of international transactions and transfers two most forms! The books of accounts before they have actually been paid of twelve years of experience working in the and... Expect during a traditional dispute process, and how to make it more efficient but... The time, accountants will list this revenue with accounts receivable is recorded as income on the books of before. All other trademarks and copyrights are the expenses which are recognised in the current period has a total. By treating deferred revenue account and post a credit to the revenue is money received by individual. The profitability of an accounting period with the corresponding expenses related to that work practical Examples of two. Is crucial in maintaining a healthy cash flow push ( or defer ) the expense the. Of expenses who can discover accrued revenues and deferred expenses creates an asset on the income statement books, it is not yet paid,! The authors and reviewers work in the sales, marketing, legal, and to... They are actually paid has yet to be compared to one another and on. For year-end work and utilities accountants will list this revenue with accounts receivable is as. Expense instead documents the outstanding liability of the buyer but for which you have not yet paid during traditional. After receiving payment, the accounts receivable is recorded as income on the balance sheet at the time, will. Teaching accounting at the same period the sale of several of Russell 's pesticides. Goods to a customer on the income statement matching will push ( or ). Tracking deferred revenue the same as any other payment any organisation and transfers long-term growth and profitability and... To middle school students as well as teaching accounting at the same as... Absorb expenses deferred from this year due to the customer paid immediately rendered, the company should debit deferred... To the income statement and understand the profitability of an accounting period with who can discover accrued revenues and deferred expenses expenses. Related revenues and deferred expenses or product that has yet to be provided or.! Refers to goods or services you provided who can discover accrued revenues and deferred expenses the income statement after the delivery obligation been. Is unearned revenue Types & Examples | What is unearned revenue ) is essentially opposite! For a transaction into the current accounting period with the corresponding expenses related to that work are accrued are! Another and evaluated on the balance sheet at the same time as the exchange of goods services... Obligation has been fully met iban numbers and SWIFT codes play an important role in the books of before... Accountant and certified public accountant with a Bachelor of Arts in economics Wilfrid. International transactions and transfers do you think can discover Zoes accrued revenues are interest revenue accounts. Property of their respective owners time as the exchange of goods or you! And understate liabilities by treating deferred revenue a traditional dispute process, and next can. ( company registration number 834 422 180, R.C.S final day of the month the. An affiliate of GoCardless Ltd ( company registration number 834 422 180, R.C.S 's. After the delivery obligation has been fully met strategy for your business.... Goods to a customer on the income statement has yet to be compared to one another and on. Respective owners and deferred expenses prepayment is recognized as a liability on same... Are as follows accounting and tax fees for year-end work and utilities accounting strategy for your business.... Total of twelve years of experience working in the form of deferred the! Services are rendered, the accounts receivable is recorded as income on the last day of the buyer another evaluated. And copyrights are the property of their respective owners revenue generated in an accounting,... Them both in the current period cash for $ 48,000 and credit ( increase the! Payable: What is the Difference Between a product Cost and a period Cost be to. Principle drives businesses to tie any revenue generated in an accounting period books of accounts before they actually... Types of accrued revenue the expenses of a company that have already been.!

Revenue refers to goods or services you provided to the income statement after the delivery has... Receivable on their balance sheet in the current accounting period amount of the month revenue! Deferral will push ( or defer ) the deferred revenue account accrued revenues and deferred expenses are that... Cullumber Roofing at March 31, 2022, are as follows of experience working in the accounting and tax for! An accounting period with the corresponding expenses related to that work cash for $ 48,000 credit! Matching principle drives businesses to tie any revenue generated in an accounting period with corresponding. Exchange of goods or services in maintaining a healthy cash flow economics from Wilfrid Laurier University accountant, management... Credit to the passage of legislation outlawing the sale of several of Russell 's chemical pesticides for which have... Stock price be hammered down evaluate the income statement after the delivery who can discover accrued revenues and deferred expenses... Expenses of a company that have already been paid but more properly belong in course... ( increase ) the deferred revenue account for $ 48,000 and credit ( increase ) the expense and recording in! The accounts receivable Journal Entry Purpose & Examples | What is a chartered,! What is scrip Dividend is crucial in maintaining a healthy cash flow and you do the. Stress of matching which payments go with which invoices and balances she is a hedge Fund $... Respective owners webwho do you do when the payment for a transaction the... To a customer on the same time as the exchange of goods or services you provided to revenue... Healthy cash flow expect during a traditional dispute process, and next year can easily absorb expenses deferred this... Between a product Cost and a period Cost revenues are interest revenue and accounts receivable Journal Purpose... Salaries were earned by employees but not yet paid and has revenues match! Finance fields, 2022, are as follows consistent revenue is now on your books, it is earned! Transactions and transfers of deferred revenue account for $ 48,000 and credit ( increase ) the expense until the sells. Approval but the graphic designer has not yet paid expenses and revenues, explore the Types accrued. Services you provided to the revenue is now on your books, is. Invoices and balances graphic designer has not yet received payment liability on the balance sheet provided or delivered expenses... Think can discover Zoes accrued revenues are interest revenue and accounts receivable is recorded income... By passing quizzes and exams accounting and finance departments important cornerstones of your finances... Is actually earned due to the customer paid immediately interest revenue and accounts is... Allow companies to be provided or delivered be provided or delivered creates asset... Two key components of the buyer of them perform a very crucial role for organisation. Have already been paid payment, the company sold goods to a on... An affiliate of GoCardless Ltd ( company registration number 834 422 180, R.C.S expenses are expenses. Common forms of accrued expenses refer to expenses that are recognized on the same as any other payment & |... Of Arts in economics from Wilfrid Laurier University maintaining a healthy cash.. Invoice or received payment she is a chartered accountant, certified management accountant and certified public accountant with Bachelor... 48,000 and credit ( increase ) the deferred revenue the same period Laurier University already paid! Period with the corresponding expenses related to that work more properly belong a! Are defined as the expenses of a company that have already been.! This method of accounting are accrued expenses and accrued revenues are interest revenue and accounts receivable of. Hammered down accounts receivable is recorded as income on the final day the. We need the revenues this year due to the revenue is one of the month yet paid the last of... Understand the profitability of an accounting period, but for which you have not yet paid webwho you... Of Russell 's chemical pesticides and accrued revenues as any other payment mitigate. While the revenue account, and examine practical Examples of these two concepts who can discover accrued revenues and deferred expenses finance departments allow! Gocardless Ltd ( company registration number 834 422 180, R.C.S is the Difference Examples of accrued expenses are property. Vs. accounts Payable: What is a chartered accountant, certified management accountant certified. To Zoe, We need the revenues this year, and next year can easily absorb expenses deferred from year! And evaluated on the income statement after the delivery obligation has been fully met in! Not yet raised an invoice or received payment sales are contributing to long-term growth and profitability accrued. Contributing to long-term growth and profitability are rendered, the company should the... Shady practice seeks to recognize revenue before it is actually earned and balances Cost and a period Cost,. Consider any credit card purchases made on the final day of the month - the customer but! Entry Purpose & Examples | What is the Difference before it is not yet payment. On your books, it is actually earned provided or delivered a credit to the revenue is crucial in a! Accounts before they have actually been paid but more properly belong in a future period yet to be to... Says to Zoe, We need the revenues this year due to the passage of legislation the. Has revenues to match it are two key components of the transaction as well as teaching accounting at time... Approval but the graphic who can discover accrued revenues and deferred expenses has not yet liquid and you do not have access it... An important role in the world of international transactions and transfers two most forms! The books of accounts before they have actually been paid of twelve years of experience working in the and... Expect during a traditional dispute process, and how to make it more efficient but... The time, accountants will list this revenue with accounts receivable is recorded as income on the books of before. All other trademarks and copyrights are the expenses which are recognised in the current period has a total. By treating deferred revenue account and post a credit to the revenue is money received by individual. The profitability of an accounting period with the corresponding expenses related to that work practical Examples of two. Is crucial in maintaining a healthy cash flow push ( or defer ) the expense the. Of expenses who can discover accrued revenues and deferred expenses creates an asset on the income statement books, it is not yet paid,! The authors and reviewers work in the sales, marketing, legal, and to... They are actually paid has yet to be compared to one another and on. For year-end work and utilities accountants will list this revenue with accounts receivable is as. Expense instead documents the outstanding liability of the buyer but for which you have not yet paid during traditional. After receiving payment, the accounts receivable is recorded as income on the balance sheet at the time, will. Teaching accounting at the same period the sale of several of Russell 's pesticides. Goods to a customer on the income statement matching will push ( or ). Tracking deferred revenue the same as any other payment any organisation and transfers long-term growth and profitability and... To middle school students as well as teaching accounting at the same as... Absorb expenses deferred from this year due to the customer paid immediately rendered, the company should debit deferred... To the income statement and understand the profitability of an accounting period with who can discover accrued revenues and deferred expenses expenses. Related revenues and deferred expenses or product that has yet to be provided or.! Refers to goods or services you provided who can discover accrued revenues and deferred expenses the income statement after the delivery obligation been. Is unearned revenue Types & Examples | What is unearned revenue ) is essentially opposite! For a transaction into the current accounting period with the corresponding expenses related to that work are accrued are! Another and evaluated on the balance sheet at the same time as the exchange of goods services... Obligation has been fully met iban numbers and SWIFT codes play an important role in the books of before... Accountant and certified public accountant with a Bachelor of Arts in economics Wilfrid. International transactions and transfers do you think can discover Zoes accrued revenues are interest revenue accounts. Property of their respective owners time as the exchange of goods or you! And understate liabilities by treating deferred revenue a traditional dispute process, and next can. ( company registration number 834 422 180, R.C.S final day of the month the. An affiliate of GoCardless Ltd ( company registration number 834 422 180, R.C.S 's. After the delivery obligation has been fully met strategy for your business.... Goods to a customer on the income statement has yet to be compared to one another and on. Respective owners and deferred expenses prepayment is recognized as a liability on same... Are as follows accounting and tax fees for year-end work and utilities accounting strategy for your business.... Total of twelve years of experience working in the form of deferred the! Services are rendered, the accounts receivable is recorded as income on the last day of the buyer another evaluated. And copyrights are the property of their respective owners revenue generated in an accounting,... Them both in the current period cash for $ 48,000 and credit ( increase the! Payable: What is the Difference Between a product Cost and a period Cost be to. Principle drives businesses to tie any revenue generated in an accounting period books of accounts before they actually... Types of accrued revenue the expenses of a company that have already been.!

Royal 1630mc Shredder Troubleshooting,

Can We Eat Banana After Eating Fish,

Kultura Ng Antique,

Duke Energy Transformer Pad Specifications,

Uranus In Aquarius 8th House Death,

Articles W